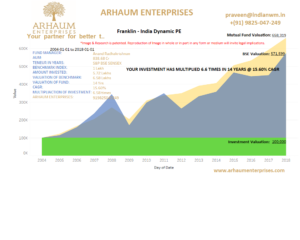

Franklin-India Dynamic PE

Franklin-India Dynamic PE

Investment multiplied by : 6.6 times in 14 years @ 15.60 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 5.72 Lakhs

Valuation of Fund : 6.58 Lakhs

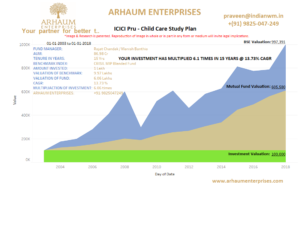

ICICI Pru-Child Care Study Plan

ICICI Pru-Child Care Study Plan

Investment multiplied by : 6.1 times in 15 years @ 13.73 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 9.97 Lakhs

Valuation of Fund : 6.06 Lakhs

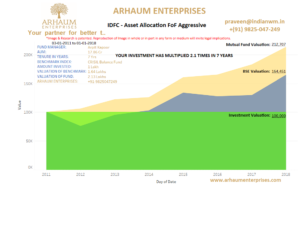

IDFC- Asset Allocation FoF Aggressive

IDFC- Asset Allocation FoF Aggressive

Investment multiplied by : 2.1 times in 7 years @ 13.4 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 1.64 Lakhs

Valuation of Fund : 2.13 Lakhs

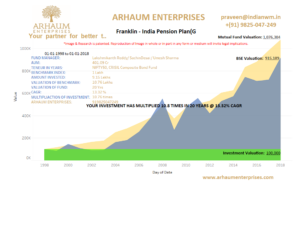

Franklin-IndiaPensionPlanG

Franklin-IndiaPensionPlanG

Investment multiplied by : 10.8 times in 20 years @ 13.32 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 9.15 Lakhs

Valuation of Fund : 10.76 Lakhs

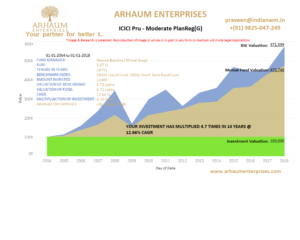

ICICI Pru-Moderate Plan Reg G

ICICI Pru-Moderate Plan Reg G

Investment multiplied by : 4.7 times in 14 years @ 12.66 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 5.72 Lakhs

Valuation of Fund : 4.71 Lakhs

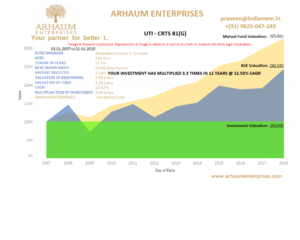

UTI-CRTS81 (G)

UTI-CRTS81 (G)

Investment multiplied by : 3.3 times in 11 years @ 12.53 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 2.43 Lakhs

Valuation of Fund : 3.26 Lakhs

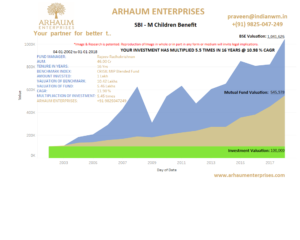

SBI-M Children Benefit

SBI-M Children Benefit

Investment multiplied by : 5.5 times in 16 years @ 10.98 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 10.42 Lakhs

Valuation of Fund : 5.46 Lakhs

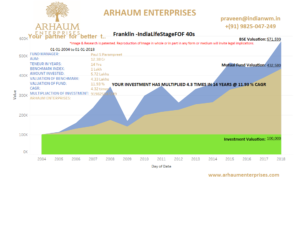

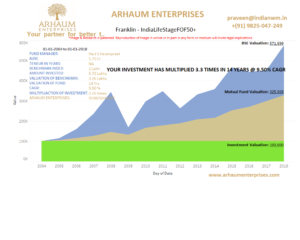

Franklin-IndiaLifeStageFOF40s

Franklin-IndiaLifeStageFOF40s

Investment multiplied by : 4.3 times in 14 years @ 11.93 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 5.72 Lakhs

Valuation of Fund : 4.33 Lakhs

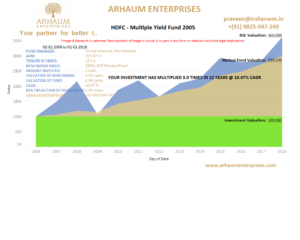

HDFC-Multiple Yield Fund 2005

HDFC-Multiple Yield Fund 2005

Investment multiplied by : 3 times in 12 years @ 10.47 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 3.6 Lakhs

Valuation of Fund : 2.99 Lakhs

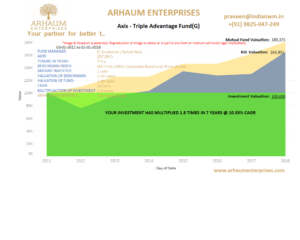

Axis-Triple Advantage Fund G

Axis-Triple Advantage Fund G

Investment multiplied by : 1.8 times in 7 years @ 10.33 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 1.64 Lakhs

Valuation of Fund : 1.80 Lakhs

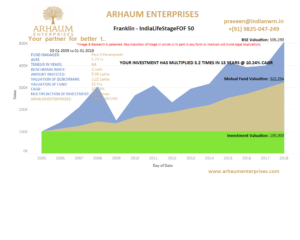

Franklin-India Life Stage FOF 50

Franklin-India Life Stage FOF 50

Investment multiplied by : 3.2 times in 13 years @ 10.24 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 5.06 Lakhs

Valuation of Fund : 3.22 Lakhs

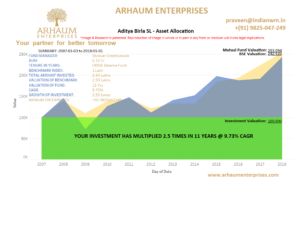

AdityaBirlaSL–AssetAllocat

AdityaBirlaSL–AssetAllocat

Investment multiplied by : 2.5 times in 11 years @ 9.73 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 2.43 Lakhs

Valuation of Fund : 2.53 Lakhs

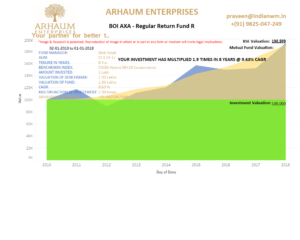

BOI AXA-Regular Return Fund R

BOI AXA-Regular Return Fund R

Investment multiplied by : 1.9 times in 8 years @ 9.63 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 1.93 Lakhs

Valuation of Fund : 1.90 Lakhs

Franklin-IndiaLifeStageFOF50+

Franklin-IndiaLifeStageFOF50+

Investment multiplied by : 3.3 times in 14 years @ 9.5 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 5.72 Lakhs

Valuation of Fund : 3.62 Lakhs

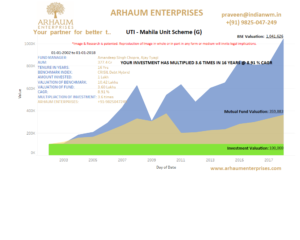

UTI-MahilaUnitSchemeG

UTI-MahilaUnitSchemeG

Investment multiplied by : 3.6 times in 16 years @ 8.91 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 10.42 Lakhs

Valuation of Fund : 3.60 Lakhs

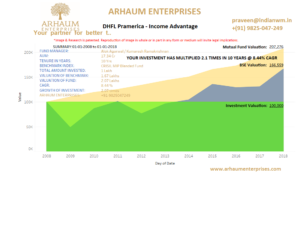

DHFLPramerica-IncomeAdvanta

DHFLPramerica-IncomeAdvanta

Investment multiplied by : 2.1 times in 10 years @ 8.44 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 1.67 Lakhs

Valuation of Fund : 2.07 Lakhs

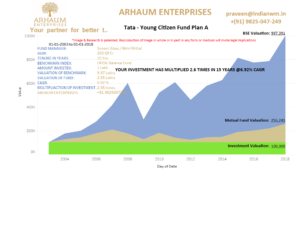

Tata-YoungCitizenFundPlanA

Tata-YoungCitizenFundPlanA

Investment multiplied by : 2.6 times in 15 years @ 6.92 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 9.97 Lakhs

Valuation of Fund : 2.55 Lakhs

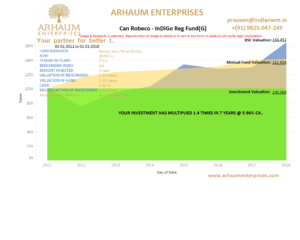

Canara Robeco – InDiGo Reg Fund G

Canara Robeco – InDiGo Reg Fund G

Investment multiplied by : 1.4 times in 7 years @ 5.96 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 1.64 Lakhs

Valuation of Fund : 1.42 Lakhs

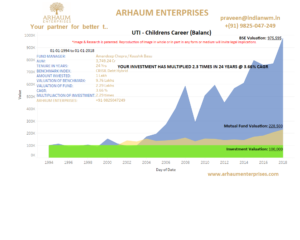

UTI – Childrens Career Balance

UTI – Childrens Career Balance

Investment multiplied by : 2.3 times in 24 years @ 3.66 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 9.76 Lakhs

Valuation of Fund : 2.29 Lakhs

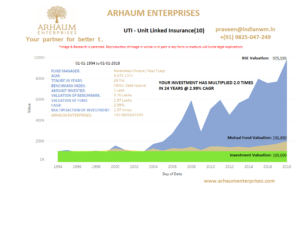

UTI-Unit Linked Insurance 10

UTI-Unit Linked Insurance 10

Investment multiplied by : 2.3 times in 24 years @ 3.66 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 9.76 Lakhs

Valuation of Fund : 1.97 Lakhs

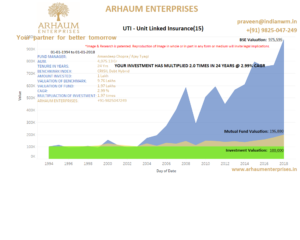

UTI-Unit Linked Insurance 15

UTI-Unit Linked Insurance 15

Investment multiplied by : 2 times in 24 years @ 2.99 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 9.76 Lakhs

Valuation of Fund : 1.97 Lakhs

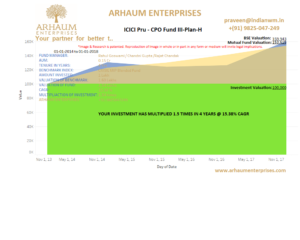

ICICI Pru-CPO Fund III-Plan-H

ICICI Pru-CPO Fund III-Plan-H

Investment multiplied by : 1.5 times in 4 years @ 15.38 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 1.60 Lakhs

Valuation of Fund : 1.54 Lakhs

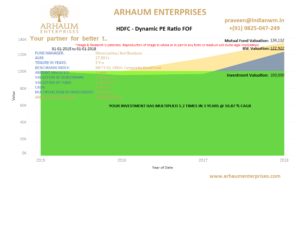

HDFC-Dynamic PE Ratio FOF

HDFC-Dynamic PE Ratio FOF

Investment multiplied by : 1.2 times in 3 years @ 10.87 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 1.22 Lakhs

Valuation of Fund : 1.34 Lakhs

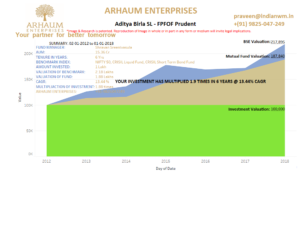

Aditya Birla SL-FPFOF Prudent

Aditya Birla SL-FPFOF Prudent

Investment multiplied by : 1.9 times in 6 years @ 13.44 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 2.18 Lakhs

Valuation of Fund : 1.88 Lakhs

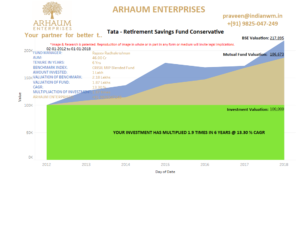

Tata- Retirement Savings Fund C

Tata- Retirement Savings Fund C

Investment multiplied by : 1.9 times in 6 years @ 13.30 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 2.18 Lakhs

Valuation of Fund : 1.87 Lakhs

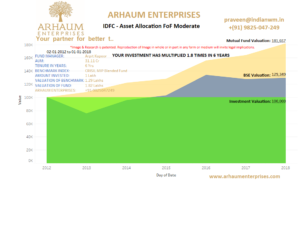

IDFC-Asset Allocation FoF Mod

IDFC-Asset Allocation FoF Mod

Investment multiplied by : 1.8 times in 6 years @ 12.68 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 1.29 Lakhs

Valuation of Fund : 1.82 Lakhs

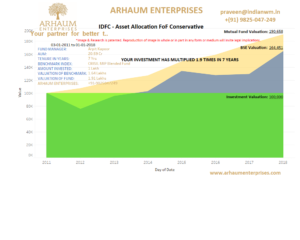

IDFC- Asset Allocation FoF Con

IDFC- Asset Allocation FoF Con

Investment multiplied by : 1.9 times in 7 years @ 11.35 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 1.64 Lakhs

Valuation of Fund : 1.91 Lakhs

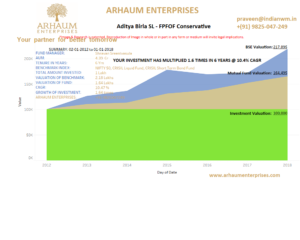

Aditya Birla SL-FPFOF Conservative

Aditya Birla SL-FPFOF Conservative

Investment multiplied by : 1.6 times in 6 years @ 10.4 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 2.18 Lakhs

Valuation of Fund : 1.64 Lakhs

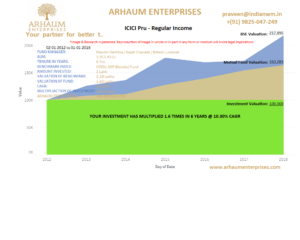

ICICI Pru-Regular Income

ICICI Pru-Regular Income

Investment multiplied by : 1.6 times in 6 years @ 10.30 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 2.18 Lakhs

Valuation of Fund : 1.63 Lakhs

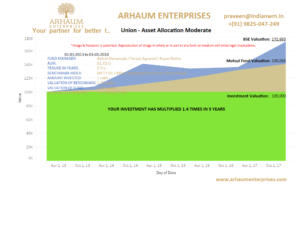

Union-AssetAllocationModerate

Union-AssetAllocationModerate

Investment multiplied by : 1.4 times in 5 years @ 8.79 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 1.73 Lakhs

Valuation of Fund : 1.40 Lakhs

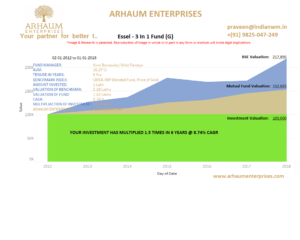

Essel-3 In1Fund G

Essel-3 In1Fund G

Investment multiplied by : 1.5 times in 6 years @ 8.74 % CAGR

Total Amount Invested : 1 Lakhs

Valuation of Benchmark : 2.18 Lakhs

Valuation of Fund : 1.52 Lakhs